Evaluate the Financial Management Company Nilus.io on Bank Connectivity

In today’s busy work world, many teams have big problems with managing cash in many banks. They need good tools to get the right info fast.

This story helps you look at the money company Nilus.io for bank links. Nilus.io is a new tool that links directly to banks. It pulls new info all the time to stop hand work and mistakes.

Money bosses, top money leaders, and big company teams often have many bank accounts in different countries. Nilus.io fixes these hard parts. It gives strong bank links and easy API connections. Teams can see all cash cleared without going into lots of bank sites each day.

What Is Bank Connectivity in Treasury Management?

Bank connectivity refers to the technology that links a company’s treasury system directly to its banks. It allows automatic pulling of balances, transactions, and statements. Without it, teams waste time downloading files manually, copying data into spreadsheets, and fixing errors.

Strong bank connectivity uses secure protocols to exchange data in real time. This includes:

- Pulling current balances

- Sending payments

- Getting transaction history

For companies in Tier 1 countries like the US, UK, and Germany, or Tier 2 markets like Brazil, India, and Mexico, reliable connectivity is key. It handles different bank standards across regions.

Nilus.io excels here by combining multiple connection methods. It supports direct APIs for fast data, SWIFT for global reach to thousands of banks, and regional protocols like EBICS in Europe. Learn more about these methods in thisdetailed glossary on bank connectivity1.

Why Bank Connectivity Matters for Corporate Treasury Teams

Treasury professionals manage global cash, liquidity, and risks. Poor connectivity leads to outdated data, slow decisions, and higher risks. Manual processes cause errors, delays, and even fraud exposure.

Good bank connectivity for treasury management delivers:

- Real-time bank feeds → for accurate cash positions

- Automated data aggregation → reducing spreadsheet reliance

- Better forecasting → with fresh transaction data

For cash and liquidity analysts, this means less time chasing data and more time on strategy. Heads of corporate finance see faster reporting and reduced close times. CFOs gain confidence in numbers for board meetings.

In multi-entity companies with operations across currencies, multi-bank connectivity platform features prevent silos. Nilus.io helps by centralizing data from all accounts into one dashboard.

Evaluate the financial management company nilus.io on bank connectivity

When you evaluate the financial management company Nilus.io on bank connectivity, its multi-method approach stands out. Nilus.io does not rely on one connection type. Instead, it blends:

- Direct APIs — For real-time, flexible exchanges with modern banks

- SWIFT networks — Accessing thousands of banks worldwide

- Host-to-Host (H2H) — Secure direct links for high-volume needs

- Open Banking APIs — Consent-based access in regulated regions

- EBICS — Popular in Europe for reliable transfers

This combination ensures broad coverage. Teams in Tier 1 and Tier 2 countries connect to local and international banks without gaps.

Nilus.io also handles various file formats and security standards automatically. This makes setup faster and maintenance easier compared to single-method platforms.

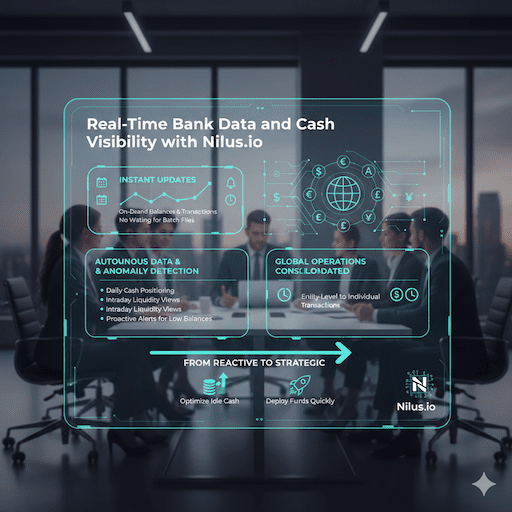

Real-Time Bank Data and Cash Visibility with Nilus.io

One top strengths of Nilus real-time bank data is its focus on instant updates. Treasury teams get on-demand balances and transactions without waiting for batch files.

Nilus.io pulls data autonomously and detects anomalies. This supports:

- Daily cash positioning

- Intraday liquidity views

- Proactive alerts for low balances

For global operations, it consolidates data across time zones and currencies. Analysts drill down from entity-level views to individual transactions.

This Nilus cash visibility solution shifts teams from reactive to strategic work. They optimize idle cash or deploy funds quickly.

Seamless ERP and Bank Integration

Nilus.io shines in ERP and bank integration. It connects to popular ERPs, pulling invoices, payables, and receivables alongside bank data.

This enables end-to-end automation, such as:

- Matching payments to invoices automatically

- Updating forecasts with actuals in real time

- Syncing data for accurate reporting

Finance technology evaluators appreciate this hub approach. It reduces custom development needs and IT involvement.

Security and Compliance in Nilus.io Connections

Security is critical in corporate banking integrations. Nilus.io uses standardized protocols with encryption and authentication.

It supports compliance like SOX and GDPR through audit trails and automated controls. Open Banking features ensure consent-based access only.

By automating reconciliation, Nilus.io lowers fraud risks from manual errors. Machine learning flags unusual patterns early.

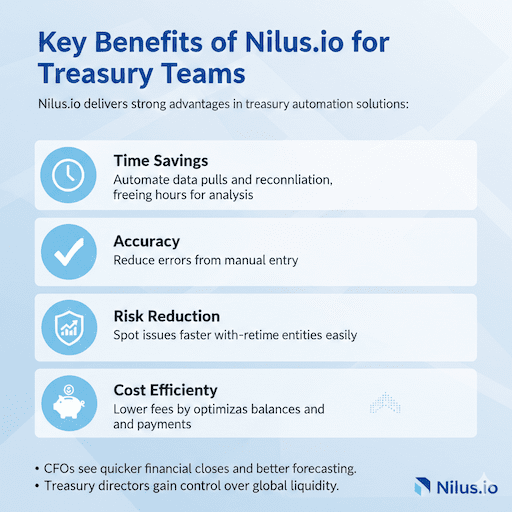

Key Benefits of Nilus.io for Treasury Teams

Nilus.io delivers strong advantages in treasury automation solutions:

- Time savings — Automate data pulls and reconciliation, freeing hours for analysis

- Accuracy — Reduce errors from manual entry

- Risk reduction — Spot issues faster with real-time insights

- Scalability — Handle growing accounts and entities easily

- Cost efficiency — Lower fees by optimizing balances and payments

CFOs see quicker financial closes and better forecasting. Treasury directors gain control over global liquidity.

Explore more in this post ontreasury management system benefits2.

Automated Reconciliation and Cash Application

Nilus.io uses AI to match transactions to records nightly. It learns patterns, suggests tags, and resolves discrepancies.

This automated bank reconciliation cuts manual effort significantly. Teams handle complex remittances or partial payments easily.

For accounts receivable, it predicts matches and speeds cash application.

Advanced Cash Flow Forecasting

With strong connectivity, Nilus.io powers accurate forecasts. AI analyzes historical data, current transactions, and scenarios.

Teams run what-if models for rate changes or delays. This supports better liquidity planning in volatile markets.

Liquidity Management and Centralized Cash

Nilus.io offers centralized cash management with policy controls and exposure views. Treasury managers pool cash virtually or optimize intercompany positions.

In Tier 2 countries with currency controls, real-time data helps navigate restrictions effectively.

Partnerships Enhancing Nilus.io Connectivity

Nilus.io builds partnerships for better access. For example, integration with major banks brings enhanced real-time capabilities to clients. Read about one such partnership bringingAI-driven cash intelligence3.

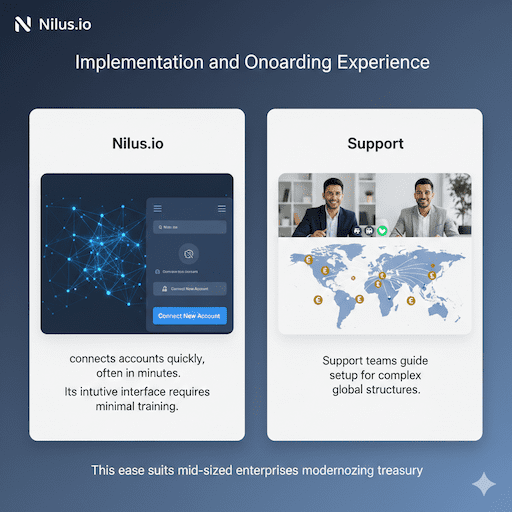

Implementation and Onboarding Experience

Nilus.io connects accounts quickly, often in minutes. Its intuitive interface requires minimal training.

Support teams guide setup for complex global structures. This ease suits mid-sized enterprises modernizing treasury.

Customer Feedback on Nilus.io

Users praise quick connectivity and reliable data. Many report major time savings in reconciliation and forecasting.

Finance leaders note the shift to strategic work. Reviews highlight strong support and regular updates.

FAQs

How does Nilus support bank links all over the world?

Nilus links to more than 20,000 banks around the world. It uses fast ways like APIs and other tools to get cash info from many places. This helps teams see all their money in one spot, no matter the country.

Is Nilus good for using many banks at once?

Yes, Nilus is very good for that. It brings info from lots of bank accounts and payment places into one easy screen. Teams can see all cash fast, work as a group, and stop doing the same work by hand.

Does Nilus give bank info right now, in real time?

Yes, it does. Nilus shows current money amounts and moves in a single screen right away. It updates on its own, or when you ask, so teams always have new info to choose quickly.

How safe are the bank links with Nilus?

Nilus keeps links very safe. It uses strong locks on data, follows big safety rules like SOC, and limits who can see what. Smart computers help spot strange things, so teams feel safe with their money info.

Can Nilus work with our ERP system?

Yes, it can. Nilus has ready links to common ERP systems to move data easily and smoothly. This helps do jobs like matching numbers on its own and gives better views without handwork.

Conclusion

Nilus is great at linking to banks. It uses many ways to connect. It shows money info right away. It uses smart computer help to do jobs fast. It works with banks all over the world. This makes it good for money teams in big companies.

Nilus stops people from doing the same work by hand. It makes things right with no mistakes. It helps people make smart choices about money.

For bosses who take care of the company’s money and top money leaders, Nilus gives good help.

In short, Nilus turns a hard bank job into something easy and strong. It gives money teams the clear view and control they need today.